The economics of co-located solar and battery storage in Germany

.jpg)

Why co-located storage is gaining momentum

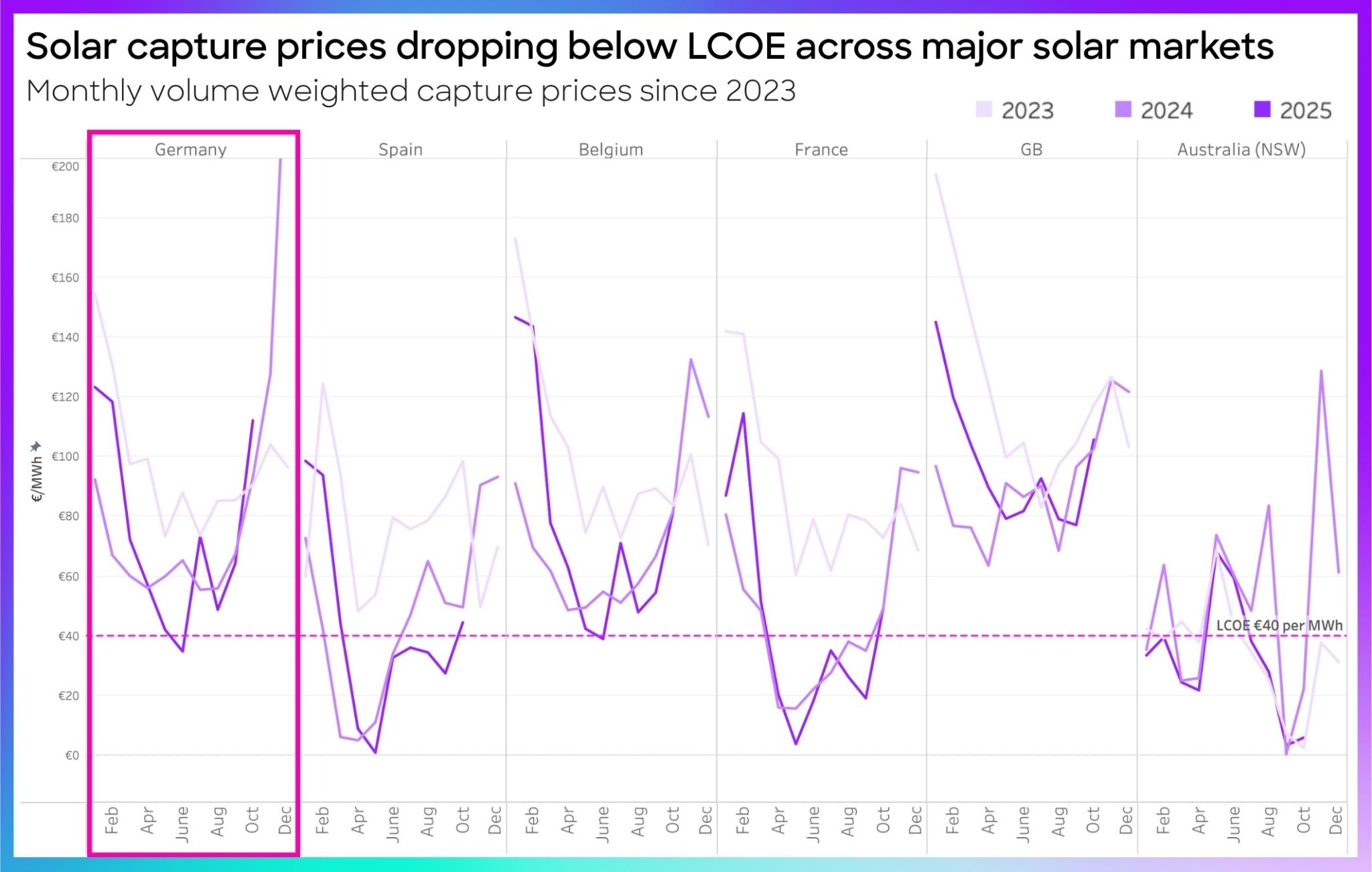

As the frequency of negative prices continues to rise, wholesale market volatility increases and solar capture rates and PPA prices are falling. Project developers are looking at new revenue models. They want to de-risk their large-scale solar-only portfolios whose revenues are sinking and at times even costing them money.

Our clients are increasingly looking at building hybrid projects and adding battery storage to existing renewable portfolios to improve revenue resilience and grid flexibility.

Thanks to the government backed innovation tenders (InnoA), around 1 GW of co-located projects are already allocated every year in Germany. However, there are more options than just that when it comes to revenue models for hybrid projects.

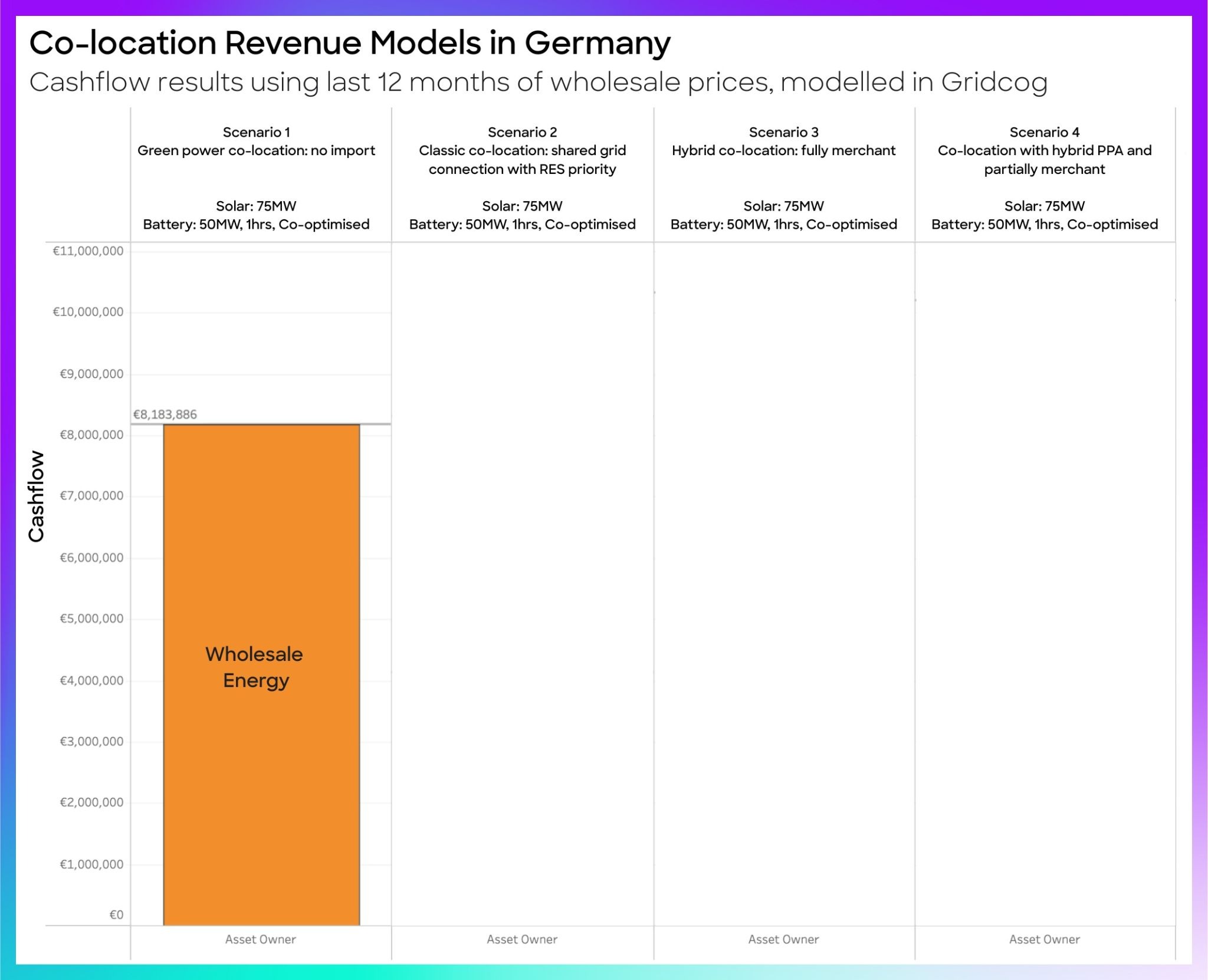

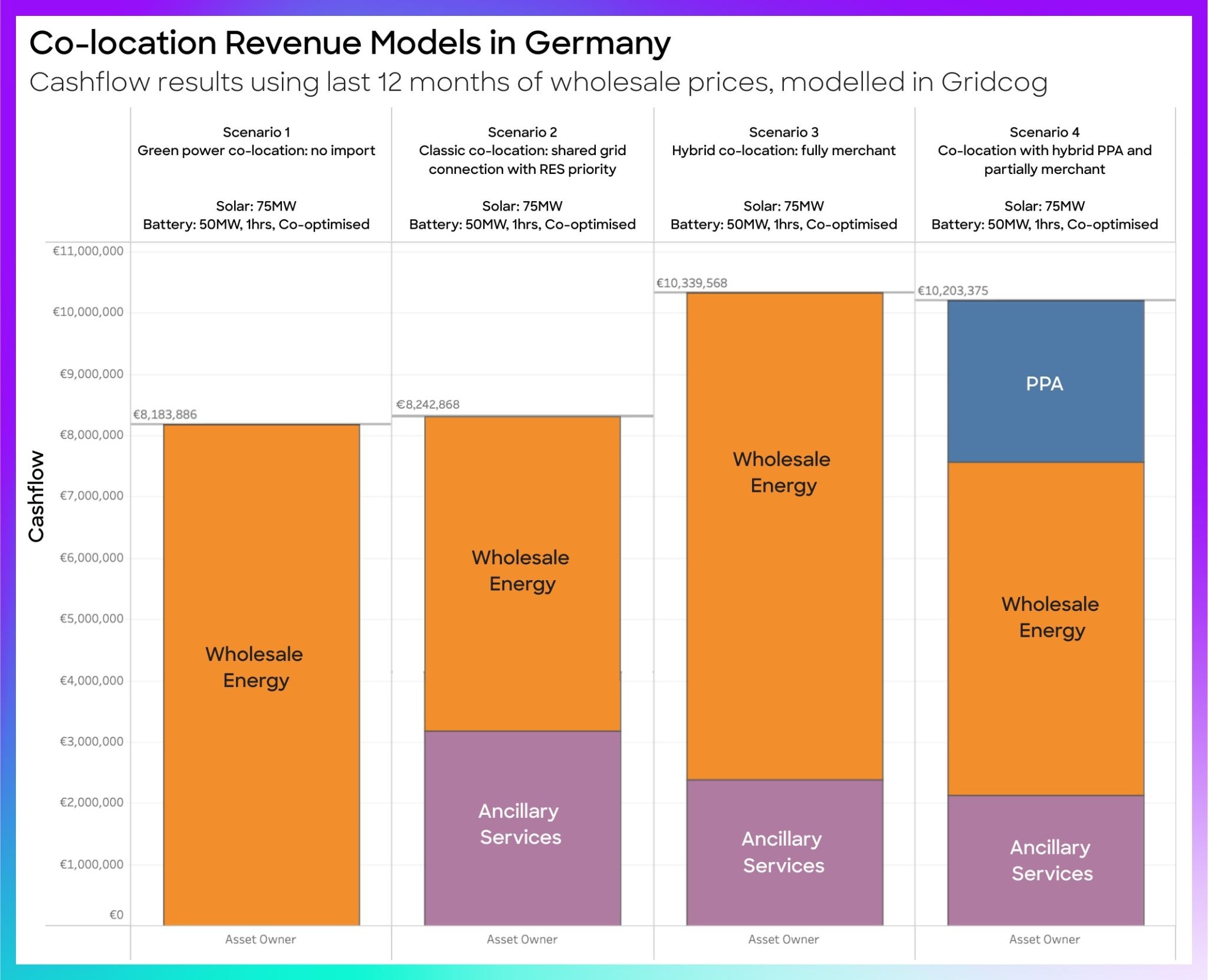

We modelled four approaches in Gridcog, to understand how they stack up against each other. Let’s dive into it.

Model 1: Subsidy backed co-located projects through innovation tenders

The first is subsidy backed projects delivered through innovation tenders. Germany is using these tenders to drive the build out of co-located projects. These schemes offer fixed subsidies for 20 years with premiums of often around 6 to 9 cents per kilowatt hour, and they have been extremely popular. The September 2025 round, for example, was four times oversubscribed.

These schemes make projects bankable while reducing risk. On the downside, they still pose restrictions, particularly around operational flexibility, like batteries not being allowed to import from the grid.

When we modelled this, revenues were stable but relatively modest. It is a good entry point, but does not capture the full flexibility of storage.

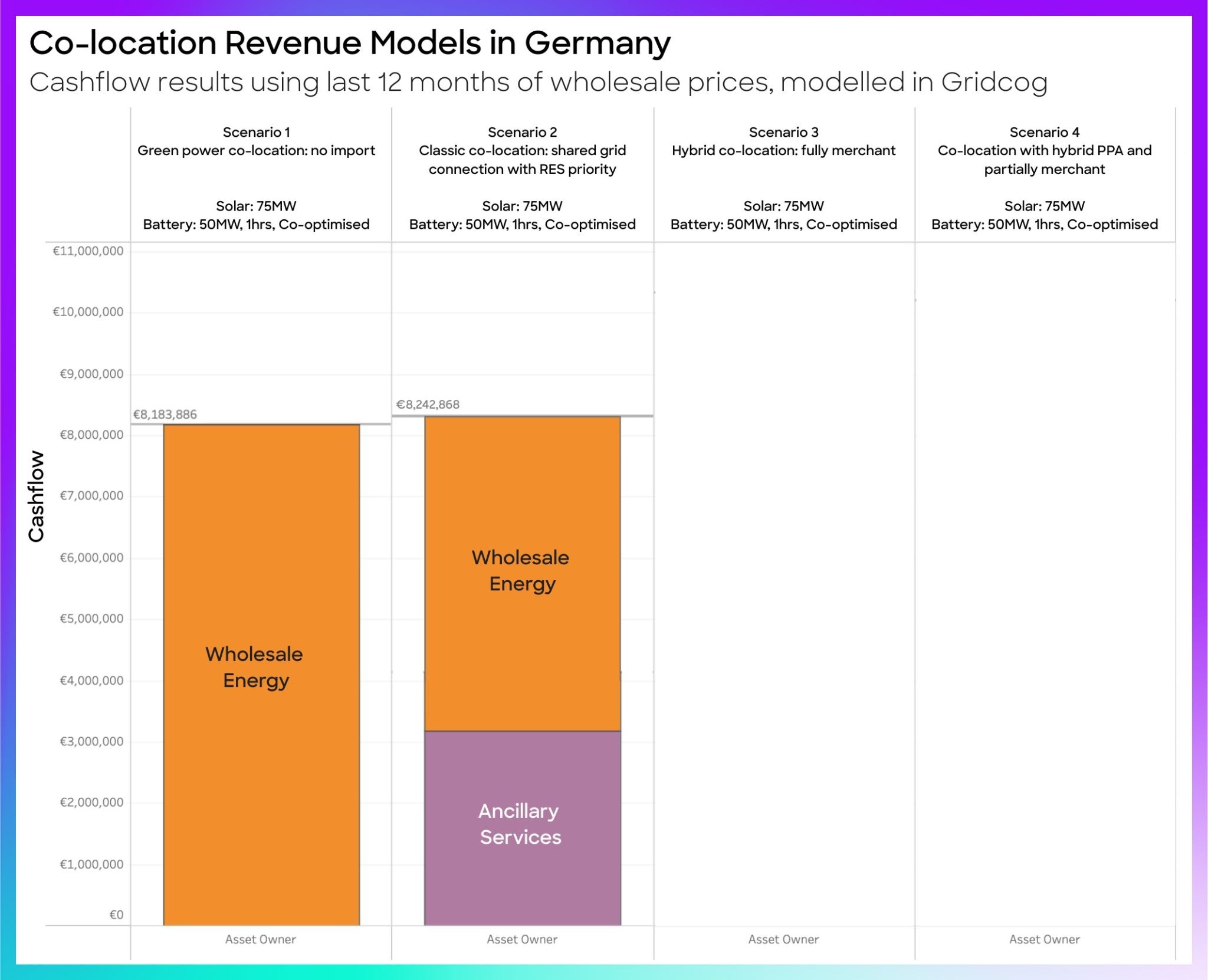

Model 2: Shared infrastructure and cable pooling

The second model uses shared infrastructure, often referred to as classical co-location or cable pooling. Due to the low capacity factors of intermittent renewable energy, around 67 percent of wind and 87 percent of solar grid capacity often goes unused, so batteries can take advantage of the headroom.

In January 2025, Germany introduced Netzüberbauung under §8a of the Renewable Energy Act. This explicitly allows developers to oversize generation and storage on one grid connection, utilising the latent capacity and improving grid efficiency, something that has been commonplace in other markets for a long time.

In our modelling, this scenario boosted returns compared to tender only projects.

For investors, this reduces connection costs and improves utilisation. In our models, this strategy gave higher revenues than pure subsidies, but returns were still capped by the renewable output profile.

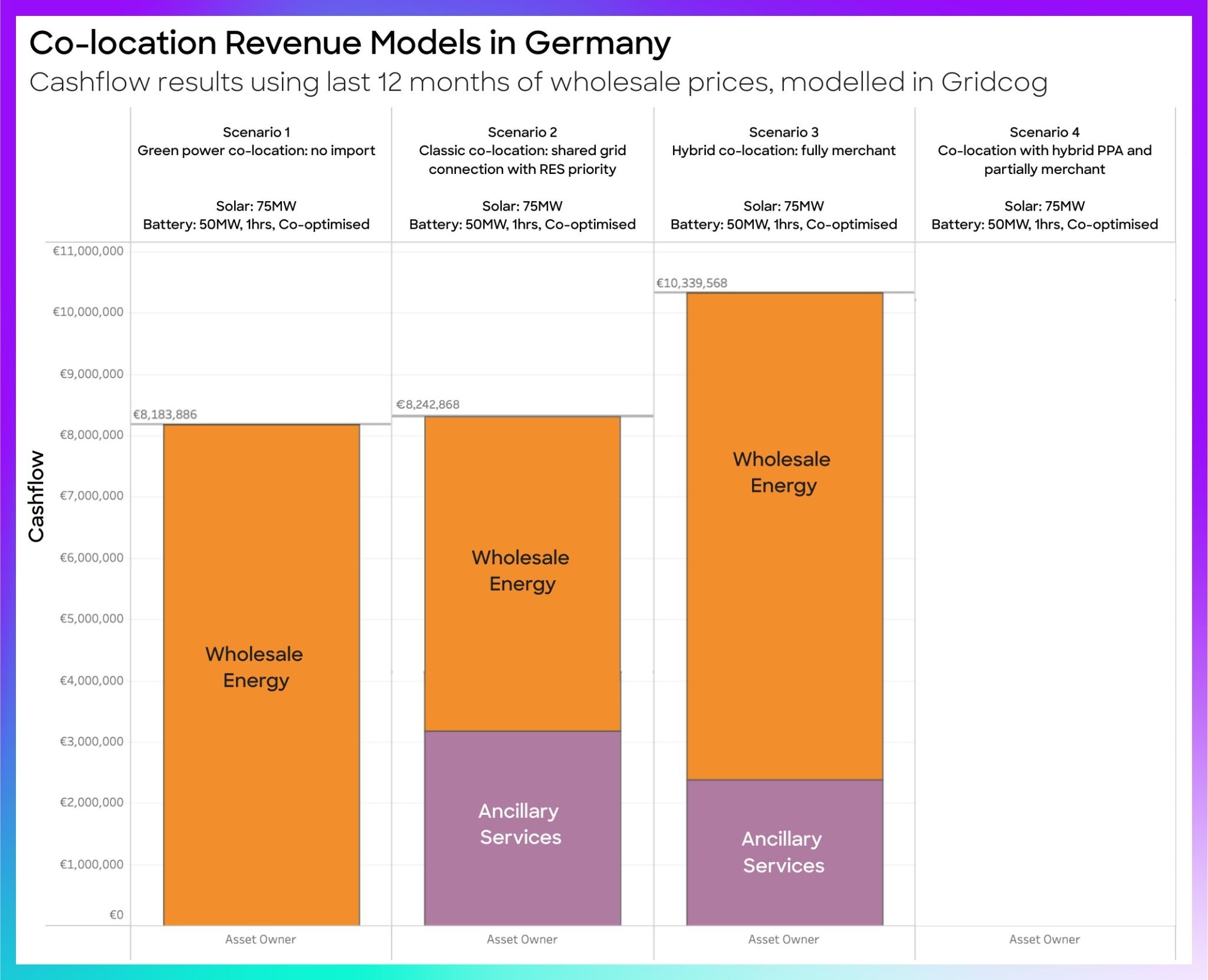

Model 3: Fully merchant co-optimisation

Our third option is the fully merchant co-optimisation. This is the high risk, high reward play. The grid connection is fully co-optimised across wholesale markets (day ahead, intraday) and ancillary services like FCR and aFRR, steering both assets accordingly.

Our Gridcog model with a 50 MW one hour battery plus 75 MW solar PV in Germany showed that merchant optimisation has by far the highest revenue potential. But of course, it is volatile and harder to finance due to uncertain cash flows and market exposure.

Model 4: Partially merchant models with hybrid PPAs

The final site is under a partially merchant model with a hybrid PPA, where part of the output is sold through a corporate or long term PPA, and the battery arbitrages the market when it is not serving that contract.

Revenues here depend on the pricing of these contracts, but in our modelling hybrid PPAs came in between tenders and full merchant. They provide stability by anchoring revenues with a PPA while still leaving room for market upside. With corporations increasingly demanding up to 24/7 green power, we see a strong appetite for this setup in the German energy market.

Which model will dominate?

Ultimately, the right revenue stack depends on investor appetite for risk, access to grid capacity, and corporate offtake demand.

At Gridcog, our platform lets developers and investors simulate exactly these scenarios, testing how revenues change under different market conditions and helping them design projects with the best commercial fit. Get in touch if we can help you with your projects.

Watch the full breakdown here:

.jpg)